As you are likely aware, provisional tax is due on the 28th of this month for May balance date clients. With the reduction in payout for the 2023/24 year and the increase in costs seen in recent years, the default payments in many cases may be too high. If you think this applies to you, please get in touch once your tax letter arrives.

Looking more closely at the Fonterra payout, the table below summarises how the current Fonterra Farmgate Milk Price is shaping up against prior years. The latest guidance for the 2023/24 season from mid-August is a range of $6.00 – $7.50 per kgMS with the midpoint being $6.67. The final payout for the 2022/23 season landed at $8.22 per kgMS and the final payment was made to farmers on 28th September 2023. For clients with Fixed Milk Price Contracts in the 2022/23 season, there was likely a reasonably significant additional payment last week with the washup for these contracts being paid out.

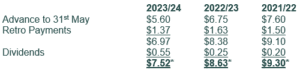

From a tax and cashflow point of view, the current payout profile is as follows:

*This excludes the Co-Operative Difference Payment which farmers received up to $0.10 if the eligibility criteria was met

Based on the above table, the 2023/24 payout is down by $1.11 per kgMS when taking into account the dividend or $1.41 excluding the dividend on the 2022/23 year. It is important to note that the $0.50 capital dividend, for those that received it, is not taxable and therefore not included in the table above.

As mentioned above, we are about to send out tax payment letters. We have reviewed where your accounts are at and you may receive an email from your client manager in advance of receiving the tax letters. Once you receive these, if you feel that the payments are too high given where income is currently tracking or cashflow is too tight to make the payments right now, we encourage you to get in touch with us as soon as possible to discuss alternative options.

With regard to cashflow, for those that received them, the final dividend payment of $0.40 plus the $0.50 capital distribution may mean that cashflow is currently okay however many budgets start to struggle as the season goes on. If there is not already a cashflow budget in place, we encourage you to think about preparing one to assist with decision making now and as the season goes on.

As always, we are here to help so please get in touch with us as soon as you can if you foresee any difficulty making your upcoming tax payments or would like assistance with putting a budget together.